Day trading can be both exciting and challenging, especially when navigating the many terms that pop up throughout the day. Whether you are just starting or looking to brush up on your trading jargon, understanding these words is going to make your trading sessions easier and more focused. In this article, I will walk you through the key day trading terminology that every trader should know.

Essential Terms for Beginner Day Traders

Having a grasp of basic day trading terms is very important when you first step into the market. The trading world is filled with slang and jargon that can be confusing without a clear explanation. These core terms form the building blocks of your trading education and can greatly influence your overall strategy.

Here are a few key terms you should know from the start:

- Bid and Ask: These represent the prices at which traders are willing to buy or sell an asset. The bid is the highest price a buyer will pay, while the ask is the lowest price a seller is willing to accept.

- Spread: This is the difference between the bid and ask prices. A narrow spread usually indicates a highly liquid market.

- Liquidity: This refers to how easily an asset can be bought or sold without affecting its price. High liquidity means you can enter or exit trades quickly.

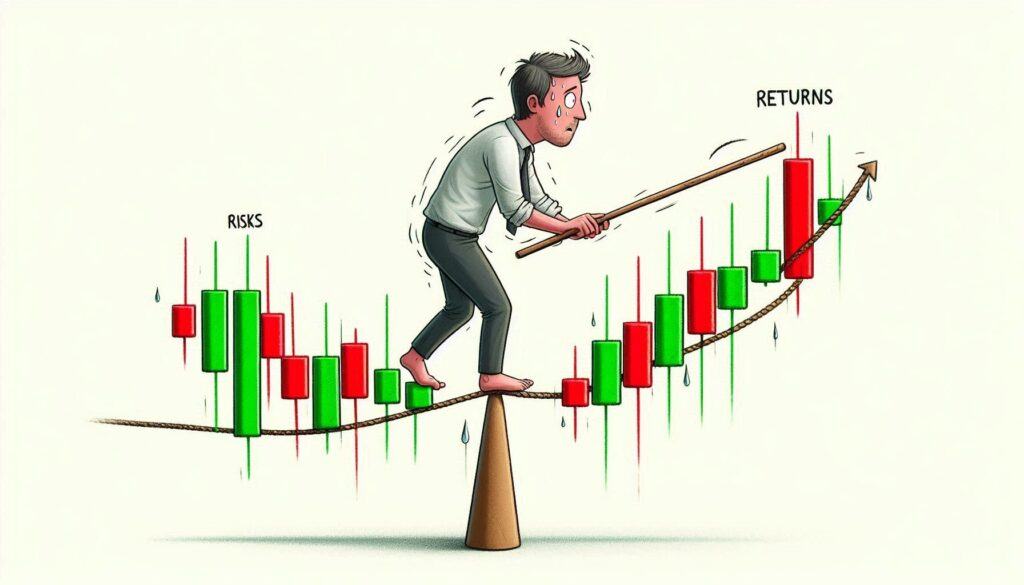

- Volatility: Volatility measures how much the price of an asset fluctuates over time. A volatile market tends to offer more opportunities but also more risk.

- Volume: Trading volume is the number of shares or contracts traded during a specific time frame. High volume often indicates strong interest in an asset.

Getting Started: Understanding Basic Order Types

Before you open your first trade, it’s important to know the different types of orders available. These are the tools that help you execute trades exactly the way you intend. As a starter, understanding these can protect you from unnecessary losses and help you capture gains when they occur.

Here are the main order types you should be familiar with:

- Market Order: This order type executes your trade immediately at the current market price. It is useful when you want to enter or exit quickly without worrying about price fluctuations.

- Limit Order: A limit order allows you to set a specific price at which you want to buy or sell. Your order will only be executed if the market reaches that price.

- Stop Order (Stop Loss): This order becomes a market order once a specified price is reached. It can help you minimize losses by selling an asset if its price drops below a set level.

- Stop Limit Order: This combines the features of both a stop order and a limit order. It becomes active once a certain price is met but will only execute at the specified limit, giving you more control over trade execution.

Using these orders strategically can help manage risk and secure profits during active trading sessions.

Challenges in Grasping Day Trading Jargon

The day trading world has its share of tricks and pitfalls, and the language itself can introduce some challenges for new traders. It’s common to feel overwhelmed when encountering terms like “margin”, “take advantage of” (formerly leverage), or “short selling.” Recognizing these challenges helps you manage your learning curve and make more informed decisions as you progress.

- Margin: This is money borrowed from your broker to purchase securities. While margin trading can amplify profits, it also increases the risk of larger losses if the market moves against you.

- Take Advantage of: Similar to margin, this concept allows you to control a larger position with a relatively small amount of capital. It multiplies gains, but also losses, so caution is advised.

- Short Selling: This strategy involves selling an asset that you do not currently own, with the hope of buying it back at a lower price. It can be risky if the asset’s price increases instead.

- Long Position: Taking a long position means buying an asset with the expectation that its value will increase over time.

- Bull Market: A market characterized by rising prices, optimism, and confidence among traders.

- Bear Market: The opposite of a bull market, a bear market is marked by declining prices and often pessimistic sentiment.

Margin and Take Advantage of Explained

Margin and the idea of taking advantage of your capital are key concepts that can both step up profits and amplify losses. Margin involves borrowing funds from your broker, which means you are putting up a fraction of the total investment amount. This borrowed money can help you control a larger position, often leading to increased profits if things go well.

However, using borrowed capital means that not only can your gains multiply, but so can your losses. It requires strict risk management and an in-depth understanding of market dynamics. For example, if a trade moves against you, the losses might exceed your initial investment, leading to margin calls and additional liabilities.

Understanding Short Selling

Short selling is another term that may seem counterintuitive for those new to trading. In a short sale, you are betting on an asset’s price to decline. You borrow shares and sell them at the prevailing market price, hoping to buy them back later at a lower cost to return the borrowed securities. This technique, while potentially lucrative, carries the risk that losses could be unlimited if the price keeps rising.

Advanced Terminology and Strategic Applications

Once you have mastered the basics, you might want to expand your vocabulary to include more advanced terms. Understanding these words can give you an edge when analyzing market trends and making strategic decisions during high-pressure trading sessions.

Here are some advanced terms and why they are important:

Technical Analysis: This involves studying historical price charts and market data to forecast future price movements. Many day traders use technical indicators such as moving averages and the relative strength index (RSI) to identify entry and exit points.

Support and Resistance: These terms refer to price levels where an asset tends to stop falling (support) or rising (resistance). Recognizing these levels helps in making informed trading choices and setting appropriate order triggers.

Moving Averages: This tool smooths out price data by creating an average price over a specific period. It helps traders detect trends and possible reversal points. Common moving averages include the 50-day and 200-day averages.

Relative Strength Index (RSI): RSI is a momentum indicator that measures the speed and change of price movements. It often signals when an asset might be overbought or oversold, aiding traders in timing their trades.

Fibonacci Retracement: This tool uses horizontal lines to indicate areas of support or resistance at key Fibonacci levels before the asset continues in the trending market.

Incorporating these advanced concepts into your trading strategies can offer deeper insights into market behavior and increase your ability to make quick, precise decisions.

Real-World Applications: Why These Terms Matter

Knowing day trading terminology does more than just boost your understanding—it directly influences your trading strategy. Accuracy in using these terms means you can communicate effectively with brokers, follow market analyses, and execute trades with confidence.

For example, a day trader who understands the bid-ask spread is aware of how liquidity affects trade execution. This knowledge allows them to choose assets with tight spreads, thereby reducing transaction costs. Similarly, being familiar with technical analysis terms helps in setting up charts that inform timely buy or sell decisions.

By mastering these words, you are better equipped to assess market scenarios, manage risks, and seize opportunities as they arise. It empowers you to make quick decisions based on reliable information rather than guesswork.

Practical Strategies for Incorporating Trading Terms Into Your Routine

Integrating these terms into your daily trading practices can significantly improve your decision-making process. Here are a few strategies that might be useful:

Start Small: Begin by focusing on a handful of terms and gradually expand your vocabulary. It helps to study one concept deeply before moving to the next.

Keep a Journal: Write down new terms, their definitions, and how they apply to your trades. Reflecting on past trades where these concepts played a role can boost your understanding.

Use Simulation Tools: Many trading platforms offer demo accounts where you can practice using various order types and strategies without risking real money. This provides a safe way to familiarize yourself with the terminology in a real-world setting.

Engage With the Community: Online forums and chat groups dedicated to day trading can provide insights into how other traders use these terms. Following experienced traders and discussing terms in context can provide practical applications and real-life examples.

Key Risk Management Practices

One of the most important aspects of day trading is managing risk effectively. Adopting proper risk management practices is not just an add-on; it is very important for sustaining long-term success in the markets. In this section, we will break down several critical strategies that can help you keep your losses under control while taking advantage of market opportunities.

First, always set clear stop loss orders when entering a trade. This simple practice can save you from catastrophic losses by automatically closing your positions when the market moves sharply against you. By setting these boundaries, you are essentially deciding in advance how much you are willing to lose on any given trade.

Next, diversify your trades. Rather than putting all of your capital into one asset, consider spreading your risk by engaging in different market sectors or instruments. This mix can help cushion the blow if one investment suffers a downturn.

Another very important technique is to keep an eye on your overall trading exposure. Avoid over-leveraging and trade with money that you can afford to lose. It is also helpful to periodically review your trading journal to identify recurring mistakes and learn from past experiences. Reflecting on your wins and losses can often shed light on areas where you might be taking unnecessary risks.

Finally, having a well-thought-out plan and maintaining discipline is essential. Stick to your trading plan even when emotions run high, and take breaks if you find that you are becoming overly stressed. Remember that consistent, incremental gains over time can be much more beneficial than large, unpredictable swings. Risk management is a dynamic and ongoing process; as markets behave differently day to day, you must be prepared to adjust your strategies accordingly.

Conclusion

Mastering day trading terminology goes beyond memorizing definitions. It is about fully understanding how these terms interact in the fast-moving market and using that knowledge to make informed decisions. A strong vocabulary can step up your efficiency and help you react quickly to changes in market conditions. Trading terminology is not just about knowing the words. It is about having a toolbox that enables clear communication, fast thinking, and appropriate execution when the markets shift.

Armed with the definitions and practical insights provided here, trading terminology becomes a tool rather than an obstacle. As you build your trading strategy, keep exploring new terms and refining your understanding of market mechanics. With practice and careful research, you can navigate the day trading landscape with greater confidence and clarity. Start incorporating these words into your daily routine. Over time, your ability to analyze and respond to market changes will improve, setting you up for a more rewarding trading experience.

This is such a helpful breakdown of day trading terms! When I first started, I was overwhelmed by all the jargon, but understanding key concepts like bid-ask spreads and stop-loss orders made a huge difference. I especially appreciate the section on risk management—so many new traders overlook that part! Do you have any favorite resources for learning technical analysis? I’m trying to get better at spotting trends and would love some recommendations. Thanks for putting this together!”

Absolutely! As someone passionate about trading, I’ve explored numerous resources that make technical analysis easier to grasp and apply. Here are a few favorites:

Books: Technical Analysis of the Financial Markets by John J. Murphy is a classic—it provides a comprehensive overview of chart patterns, indicators, and trend analysis. Another favorite is Trading in the Zone by Mark Douglas, which combines trading psychology with technical insights.Online Platforms: Websites like Investopedia are great for understanding the basics of technical analysis. TradingView also offers excellent charting tools and a community of traders sharing strategies.Courses: Udemy and Coursera have accessible courses specifically designed for beginners and advanced traders wanting to master trend spotting.Practice: Using demo accounts on platforms like ThinkorSwim or MetaTrader lets you test strategies without real financial risk.

What tools or strategies have caught your eye so far? Let’s dive deeper into those!